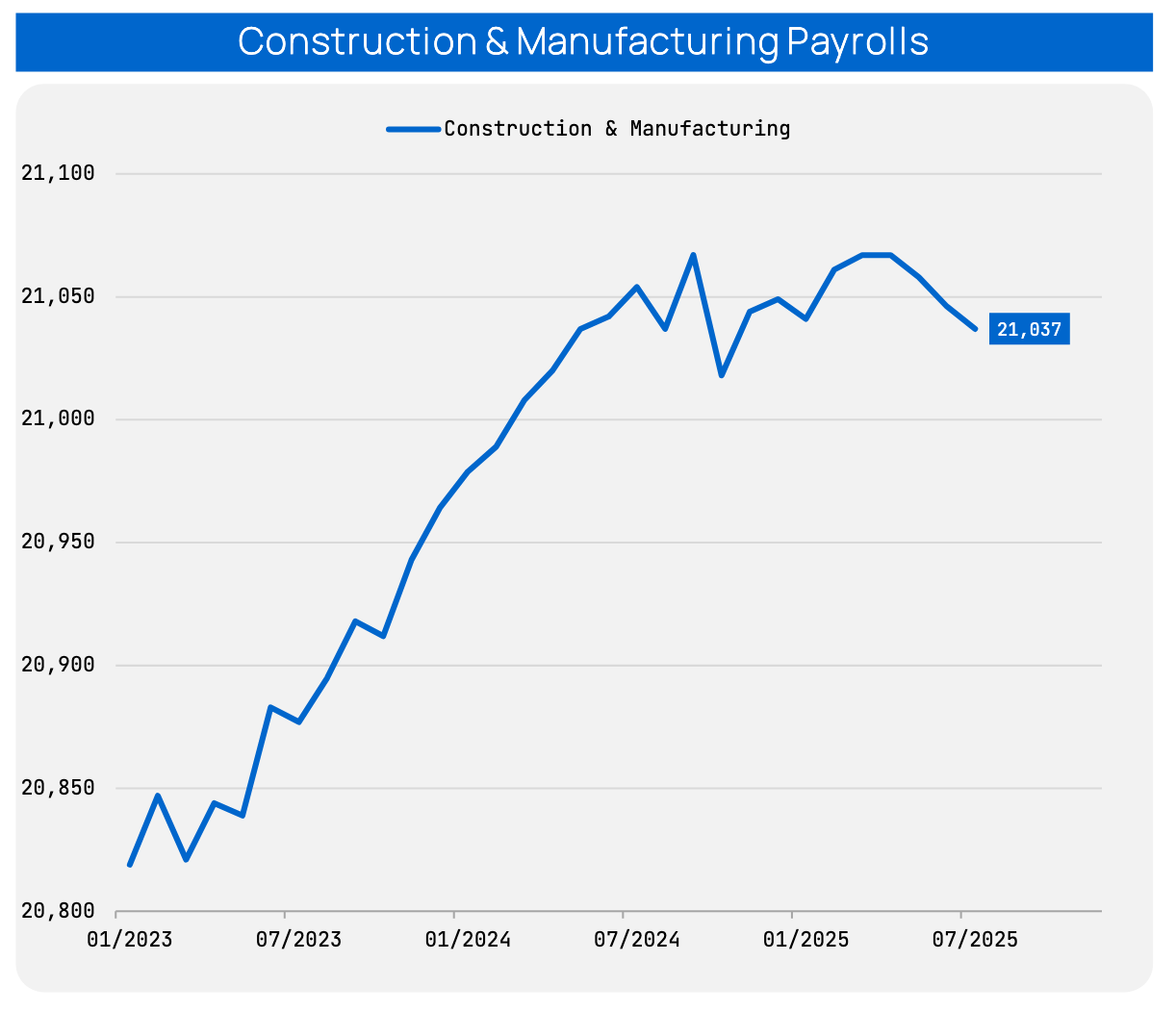

Cyclical Job Losses Begin: Why It Matters More Than the Headline Jobs Number

You won’t find this chart in the headlines, but it might be the most important signal in last week’s employment report.

Construction and manufacturing payrolls just turned negative year-over-year. That may sound niche, but historically, it’s the part of the economy that leads job losses into recessions.

Here's the data from Eric Basmajian:

The cyclical economy (construction, manufacturing, goods-producing sectors) is where job losses start. Even though services make up ~80% of GDP, recessions begin when the cyclical economy weakens. That weakness eventually spills over, setting off the unemployment cascade. This has happened in every modern downturn. It’s not about precise timing or magnitude, it's about sequence.

This chart isn’t flashy. It doesn’t give you a stock pick. But, it is the kind of rigorous work that actually helps us understand what’s happening. Eric Basmajian deserves much credit here. His disciplined, basket-based approach gets far closer to economic truth than any mainstream financial outlet I know. If you're unfamiliar with his business cycle work, check it out here.

This is exactly the kind of signal Alethia exists to highlight. From ETF flows to options positioning to banking reserves, there’s real signal buried in the noise, but only if we take an empirical lens to it. Think part Karl Popper, part Charlie Munger.

Alethia is building structured data feeds and LLM-powered lenses to help us ask the right questions, stay curious, and notice the real shifts before the narratives catch up.